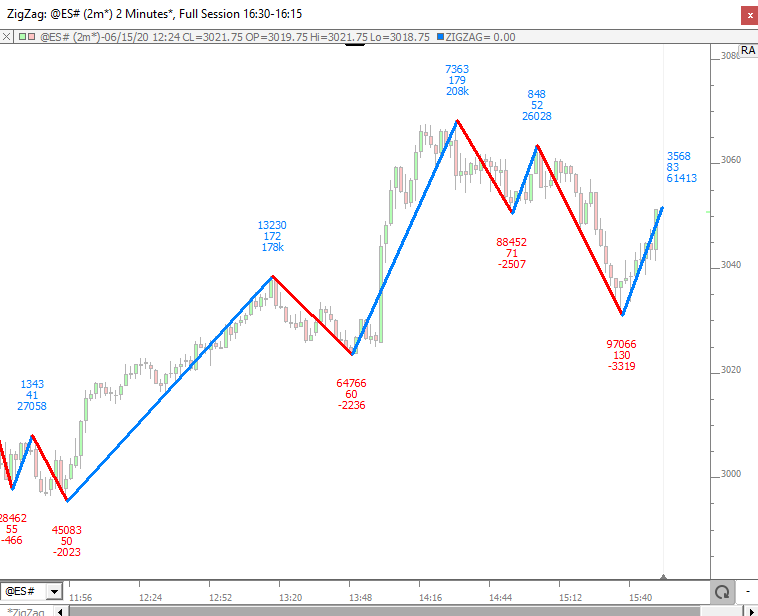

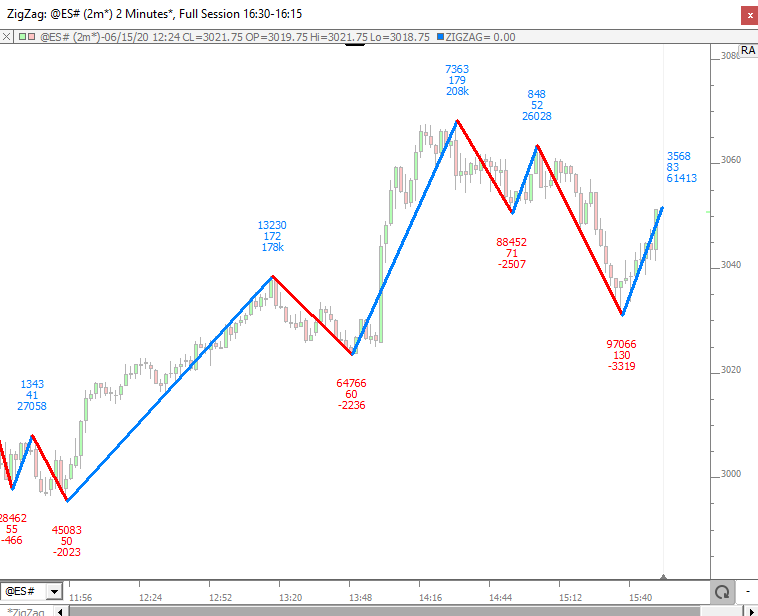

This indicator can automatically plot the highs and lows and thus identify the traders to any potential ABCD patterns.Īdditionally, using an oscillator helps in identifying the turning points once pivot swing point D is formed. A good way would be to make use of the zig-zag indicator found with the MT4 trading platform. The ideal way to get started with the ABCD pattern is to look for highs and lows in the price. The ABCD is a recurring pattern that is repeated over and over in the price charts, with each of the patterns qualify any of the rules mentioned above forming any of the 3 patterns. Traders should note that the ABCD count should not be confused with the ABC corrective waves from the Elliott Wave count. After the D point has been identified, a buy order would be place at or above the high of the candle at point D. The chart below illustrates a Buy trade example where we notice that BC retraced close to 61.8% (at 59.4%) after which CD travelled close to 139.6% of the AB leg. The opposite rules apply for bearish ABCD patterns.

If the CD leg is covered within just a few price bars as compared to the AB leg, then it is an indication that the CD leg will be an extension of AB. In most cases, AB and CD are equal in time and price. Appearance of wide range bars near point C is also an indication that CD will be an extended leg. When there is a gap formed after point C, it indicates that the CD leg will be much larger than the AB leg ( ? Read more about Gap Trading ). CD leg usually slopes at an angle that is wider than the AB leg. CD can be an extension of AB anywhere from 1.272% up to 2.00% and even greater. CD must be 127.2% or 161.8% of AB or of CD. Point D must be a new low below point B. In strong markets, C can trace only up to 38.2% or up to 50% of AB. C usually retraces to 61.8% or 78.6% of AB. C must be lower than A and must be the intermediate high after the low point at B. When AB is identified, the next step is to plot BC. Swing points A and B form the highest high and the lowest low of the swing leg.

The chart below shows the three different ABCD bullish patterns. ABCD extension: CD leg is an extension of AB between 127.2% – 161.8%.

Classic ABCD: In this pattern, the BC is a retracement of 61.8% – 78.6% of AB, with CD being the extension leg of 127.2% to 161.8% (equal in price distance). Price and Time: Under this type of ABCD pattern the amount of distance and the time it takes for price to travel from A to B is equal to the time and distance from C to D. Within the ABCD patterns, there are 3 types as mentioned below. It was developed by Scott Carney and Larry Pesavento after being originally discovered by H.M Gartley.

Classic ABCD: In this pattern, the BC is a retracement of 61.8% – 78.6% of AB, with CD being the extension leg of 127.2% to 161.8% (equal in price distance). Price and Time: Under this type of ABCD pattern the amount of distance and the time it takes for price to travel from A to B is equal to the time and distance from C to D. Within the ABCD patterns, there are 3 types as mentioned below. It was developed by Scott Carney and Larry Pesavento after being originally discovered by H.M Gartley.

The ABCD pattern shows perfect harmony between price and time and is also referred to as ‘measured moves’. The ABCD pattern ( AB=CD) is one of the classic chart patterns which is repeated over and over again.

0 kommentar(er)

0 kommentar(er)